What are they?

CVA’s have been widely reported in recent months, with some of the UK’s biggest retailers entering into these arrangements. But what is a CVA, and what are the benefits?

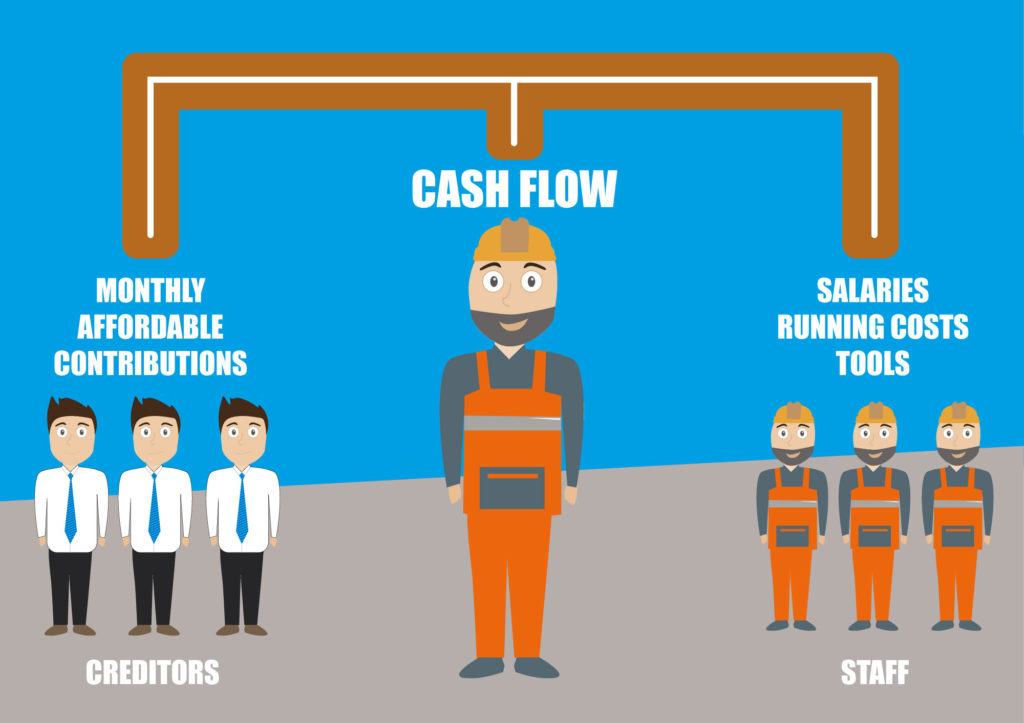

A CVA is a Company Voluntary Arrangement. The process allows a struggling business to restructure its estate, or make affordable contributions to its debts, over a defined period.

A business will usually enter into a CVA if the only other feasible alternative is Administration, meaning that there must be a viable business at the core. Importantly, a CVA can only be implemented if at least 75% of the company’s creditors’ agree to its proposals. If the required majority do not agree, then the CVA cannot be approved.

Do they work?

A CVA in itself cannot repair a struggling business. But, it can provide an opportunity for it to consider what works well, and what doesn’t. With the help of an experienced Insolvency Practitioner, a CVA can be an opportunity for a business to make operational changes which would enable it to return to profitability.

The process has received some negative publicity, particularly from Landlords. A number of struggling retailers (Carluccio’s, House of Fraser and Mothercare) all sought approval for CVA’s which required landlords to accept lower rent, in order to avoid financial collapse.

However, there are several success stories where proposals have been effectively implemented and the distressed company has returned to prosperity. Take Mamas & Papas, which entered into a CVA in September 2014 and concluded the process in November 2017.

The approved terms of their arrangement allowed all 60 outlets to continue trading as normal, and the company honoured customer deposits and gift cards, thereby protecting the brand for the future.

What are the benefits?

- The company will continue trading and the majority, if not all jobs, can be protected.

- The company will set out what it can afford to pay to creditors, and how that compares to the company entering into Administration.

- Landlords may favour a CVA, even at a reduced level of rent, as it may be easier and less costly than having vacant premises.

There are risks to a CVA and it these should also be considered. With nearly 20 years of experience, The Business Debt Advisor is experienced in helping with company debt solutions. For more advice please contact a member of our team on 0333 9999 689.