Article by Laura Walshe of The Business Debt Advisor

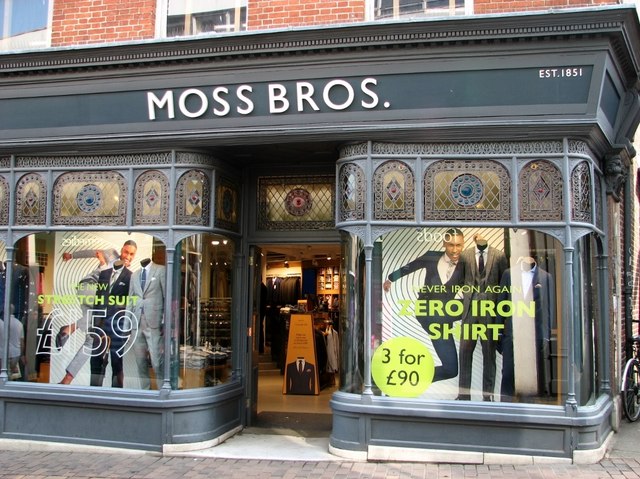

Moss Bros Group PLC was originally founded in 1851 in London. The company has previously been one of the UK’s top menswear outlets, specialising in menswear for formal occasions, and currently ranked in the Top 50 of the IRUK Top 500 (Internet Retailing UK).

Despite this longevity, the company is not immune to the challenges affecting the retail sector, having reported its first pre-tax loss in eight years.

Fashion retailer Ted Baker has also posted its first reduction in annual profit since 2008, reiterating the fraught conditions on the British high streets.

Throughout 2018 a string of well known brands were forced into restructuring deals, or ceased trading altogether, which led to the closure of hundreds of stores.

What are the challenges?

Moss Bros struggled through 2018 for a number of reasons.

At the start of the year it suffered from stock shortages, and reduced footfall. Performance in the summer was affected by the heat wave and this culminated in higher than planned discounting throughout the Christmas period.

The group reported revenue of £129M in the year to 27 January 2019, down by 2.1% on the same time in 2018. This resulted in a pre-tax loss of £47.2M after one-off costs of £3.8M, including the costs of reorganisation and other write-downs.

In a statement alongside the company’s latest financial report, Chief Executive Officer (CEO) Brian Brick said: “In common with many UK retailers, we continue to anticipate an extremely challenging retail landscape, particularly within our physical stores, as a result of reduced footfall and rising costs.”

Efforts to bounce-back

Moss Bros Group scrapped its final dividend payment to shareholders and cut the total dividend for the year to 1.5 pence per share, from 4 pence per share in the previous year.

As with any struggling business, this decision seems entirely sensible at a time when the business is struggling.

More recently, the group announced the appointment of Joules CEO Colin Porter as a non-executive director, with immediate effect.

Porter said: “I am really excited to be joining the board and taking up the role of chairman of Moss Bros, which is a company with a great heritage, committed colleagues and tremendous opportunities for growth. I am looking forward to working with Brian Brick, our CEO and the rest of the team.”

What to do if your business has reducing profit?

For business owners understanding (and keeping tight control of) its financial affairs is one of the best ways to make sure that it remains profitable.

Maintaining your business finances means you can avoid unforeseen business debt and problems with cash flow. Having clear financial projections can help to anticipate future bumps in the road.

It is also beneficial to review direct expenses and other costs. These can mount quickly but reviewing them allows you to make sensible adjustments.

For further information on business survival and key tips on driving profitability please see here.

If your business is experiencing financial pressure or you have any concerns about future trading then please fill out our Contact Form and we will be in touch. Alternatively, call us on 0800 781 0990.

Our team has extensive experience and can arrange an initial consultation at no cost, usually on the same day.