Article by Bev Budsworth MD of The Business Debt Advisor Personal Guarantees or “PG’s” It is almost impossible to avoid personal exposure to debt when setting up your limited company/business. Banks, other funders, suppliers, leasing companies frequently will require directors or shareholders to provide personal guarantees, “PG”’s as additional...

London Capital & Finance Collapse: Thousands Of Customers Unlikely To Get Compensation

Thousands of first-time investors who lost their savings through London Capital & Finance (LCF) have been told they are unlikely to receive compensation. Nearly 12,000 customers invested more than £236m in total into the high-risk bond scheme before LCF collapsed in January. As reported by the BBC, the scheme was marketing as...

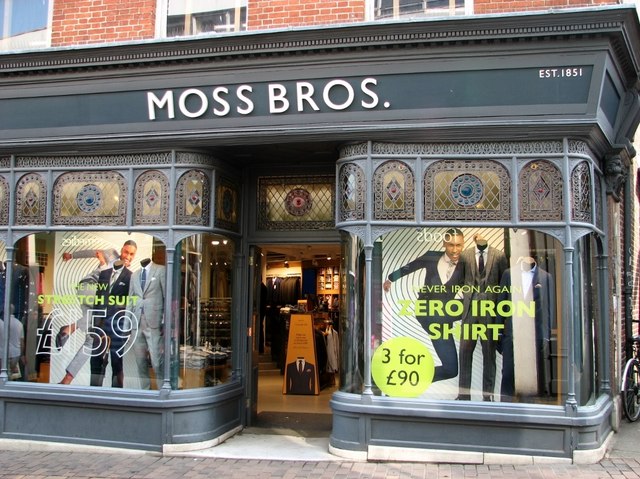

Is Moss Bros ‘Out of Fashion’?

Article by Laura Walshe of The Business Debt Advisor Moss Bros Group PLC was originally founded in 1851 in London. The company has previously been one of the UK’s top menswear outlets, specialising in menswear for formal occasions, and currently ranked in the Top 50 of the IRUK Top 500 (Internet...

Making Tax Digital – Is Your Business Prepared?

Article by Laura Walshe of The Business Debt Advisor Making Tax Digital is part of government plans to make it easier for individuals and businesses to get their tax liabilities correct and keep on top of their affairs. The initiative will implement fundamental changes to the way the current tax system...

What’s the use of limited liability for directors?

By Bev Budsworth of The Business Debt Advisor and Joss Dicks of Personal Guarantee The benefit of trading through a limited company or limited liability partnership has been seriously eroded over the years. It used to be just the banks that asked for personal guarantees, but over the years, requesting...

Dissolution Vs Liquidation Made Simple

Article by Laura Walshe of The Business Debt Advisor At the end of last year, there were over 4 million companies on the Companies House register, which included those in the process of dissolution and liquidation. From October to December 2018 alone, there were 158,841 incorporations and 112,121 dissolutions. Even with...

Business Survival – Tips on Driving Profitability

Article by Laura Walshe of The Business Debt Advisor Small and medium sized enterprises (SME’s) make up the majority of businesses operating within the UK. In 2018, there were 5.7 million private sector businesses operating within the UK, down by 27,000 compared to 2017. This is the first year-on-year fall in...

What are an employee’s rights during insolvency?

Article by Laura Walshe of The Business Debt Advisor Learning that you are at risk of redundancy is stressful in any situation. Being made redundant as a result of your employer entering into an insolvency process can be even more distressing. In many cases where a company pursues an insolvency solution,...

The Protection of Consumer Prepayments During Company Insolvency

Article by Laura Walshe of The Business Debt Advisor 2018 was a turbulent year for retail, as we saw the disappearance of Poundland, Toys R Us, and Maplin. In the same period, numerous other household names were forced into restructuring deals, which led to the closure of hundreds of high-street...

A Directors Guide to Insolvency: How to recognise it

Article by Laura Walshe of The Business Debt Advisor There have been several high-profile insolvencies within the last year. Formal insolvency processes such as Administration and Liquidation appear to be becoming increasingly prevalent, affecting businesses that are familiar to us all. But how do company directors recognise if their business...

Unlawful Dividends – What Directors Need To Know

Article by Laura Walshe of The Business Debt Advisor One of the advantages of operating a limited company is that a Director can draw remuneration in a number of ways. For instance, it is common for Directors to take basic salary and dividends. This is usually a tax efficient method...

2019 and brexit will bring new threats and opportunities for business

Article by Bev Budsworth MD of The Business Debt Advisor As 2019 begins, the year ahead promises to bring new challenges for businesses across the UK but also new opportunities and chances for growth. Brexit and Uncertainty The UK is due to leave the European Union on March 29th this...

Consultation findings on improvements to Insolvency and Corporate Governance

Consultation findings on improvements to Insolvency and Corporate Governance The government opened a consultation on Insolvency and Corporate Governance which ran from 20 March 2018 and closed on 11 June 2018. Details of the responses received and the outcome of the consultation can be viewed at:- https://www.gov.uk/government/consultations/insolvency-and-corporate-governance The aim of...

HMRC debts and Time to Pay Plans

HMRC debts and Time to Pay Plans A Time to Pay Arrangement (TTP) could allow your business to pay debts to HM Revenue and Customs (HMRC) over a longer period of time than would otherwise be available. A TTP is commonly used to repay arrears of Corporation Tax, PAYE or...

Why Should You Formally Liquidate Your Company

Article by Bev Budsworth MD of The Business Debt Advisor So why does it makes sense to liquidate? Claiming monies from the Redundancy Fund I was recently instructed to provide advice to a company who had used most of the cash at bank to pay employees wages and were now...

Company Dissolutions and Liquidations Made Simple

Companies on register hits new high The total number of companies registered in the UK surpassed 4 million for the first time ever in March 2018. Private companies account for a massive 92.8% of companies registered. Dissolutions are also on the up with over 100,000 companies dissolving every quarter since...