MPs have criticised a HMRC tax crackdown which attempts to claw back money from people who used tax-planning schemes they thought were legal. As reported by The Independent, the politicians warned that the new measures have caused "widespread anxiety and distrust" and have claimed that the "loan charge" has driven...

Councils sue 750 firms a day struggling with business rate arrears

Around 190,000 shops, pubs and other firms have been sued by councils in the past year for struggling to pay rising business rates, according to new data. That equates to 750 firms every working day who were taken to court for non-payment of their business rates during the 2018/19 financial year. Under...

Business investment declines with threat of ‘No Deal Brexit’ – how it could affect UK business owners

The threat of a 'No Deal Brexit' has sapped business confidence to its lowest level in a decade, with Britain reportedly on course for the biggest decline in business investment since the financial crisis. According to a Deloitte survey of Chief Financial Officers across the UK, CFOs are more pessimistic about...

The Business Survival Checklist

Article by Laura Walshe of The Business Debt Advisor It has been broadly reported that company insolvencies in the UK increased in the first quarter of 2019 with some insolvency processes at their highest level in five years. The team at The Business Debt Advisor has reflected on why businesses fail and...

Dealing with Late Payment of Commercial Debt

Article by Laura Walshe of The Business Debt Advisor Nearly 25% of UK businesses report that late payment of invoices threatens their survival. Last year, The Federation of Small Businesses (FSB) obtained assurances from the Chancellor of the Exchequer that the Government will take steps to crack down on the late...

Why Do Businesses Fail?

Article by Laura Walshe of The Business Debt Advisor The UK is full of ambitious and talented business owners with thousands of new ventures launched each month. Despite this, the overall number of company insolvencies in the first quarter of 2019 increased. The latest statistics on company insolvencies in England and Wales...

British Steel To Enter Insolvency – What Went Wrong?

British Steel is set to enter insolvency, a move which will put more than 5,000 jobs at risk. The manufacturing company is on the verge of collapse after a breakdown in rescue talks between the government and the business' owner, Greybull. As reported by the BBC, the Government's Official Receiver will...

Dealing with Judgment Debt

Article by Laura Walshe of The Business Debt Advisor A County Court Judgment (CCJ) is essentially a County Court Order which enforces the payment of an unpaid debt. A CCJ against a limited company is likely to be the culmination of several attempts by a creditor to recover unpaid debt. If...

Managing Risk – Is your business prepared for Brexit?

Article by Laura Walshe of The Business Debt Advisor The UK’s departure from the European Union will inevitably mean change for businesses across all sectors, including small enterprises. While some businesses are already planning for the challenges and opportunities ahead, it would be useful for all companies to review current processes...

When is Voluntary Liquidation suitable for your business?

Article by Laura Walshe of The Business Debt Advisor There are many great reasons to start a business, but taking on the challenge of running a successful enterprise is not for the faint-hearted. At the end of 2018, the number of companies listed on the Companies House register was 3,879,844 (excluding...

Bolton Wanderers FC – Troubled Club Survives High Court Hearing

Article by Laura Walshe of The Business Debt Advisor Bolton Wanderers FC is no stranger to financial difficulty, having faced several winding up petitions for unpaid taxes within the last 18 months. But the club survived another hearing in the High Court yesterday, after it was granted an additional five weeks...

London Capital & Finance Collapse: Thousands Of Customers Unlikely To Get Compensation

Thousands of first-time investors who lost their savings through London Capital & Finance (LCF) have been told they are unlikely to receive compensation. Nearly 12,000 customers invested more than £236m in total into the high-risk bond scheme before LCF collapsed in January. As reported by the BBC, the scheme was marketing as...

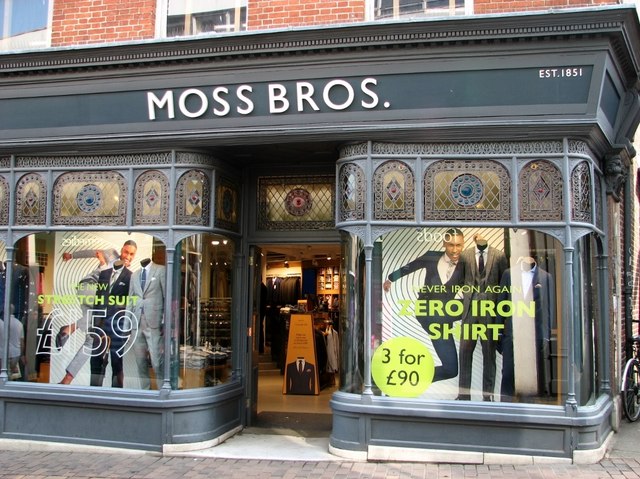

Is Moss Bros ‘Out of Fashion’?

Article by Laura Walshe of The Business Debt Advisor Moss Bros Group PLC was originally founded in 1851 in London. The company has previously been one of the UK’s top menswear outlets, specialising in menswear for formal occasions, and currently ranked in the Top 50 of the IRUK Top 500 (Internet...

Making Tax Digital – Is Your Business Prepared?

Article by Laura Walshe of The Business Debt Advisor Making Tax Digital is part of government plans to make it easier for individuals and businesses to get their tax liabilities correct and keep on top of their affairs. The initiative will implement fundamental changes to the way the current tax system...