In November 2020, HMRC updated its policy page around how it will continue to support taxpayers and the economy going forward into 2021.

INSOLVENCY TRADE BODY R3 LAUNCHES NEW COVID CVA PROPOSALS

R3 together with law firm Fieldfisher have launched a new Covid Company Voluntary Arrangement “CVA” standard proposal template for smaller businesses. This is a very welcome addition to the rescue tools needed to help SME’s.

What Is The Insolvency Moratorium?

The moratorium grants a business ‘breathing space’ from its creditors to allow a plan to be formed to restructure the company’s debts. Initially a break of 20 business days is granted, however this can be extended by a further 20 business days by filing an extension with the court. Further...

Postmasters celebrate huge victory against convictions

Over the past 10 + plus years there have been problems with the security of the Post office system and had led to hundreds of post masters being prosecuted for theft of funds from the Post office. Senior Post Office executives were told back in 2011 that the Horizon system...

RECOVERY PLAN FOR COVID CRUSHED (ZOMBIE) BUSINESSES

By Bev Budsworth, MD of the Business Debt Advisor Covid Crushed (Zombie) Business I am not a fan of the term “Zombie”for a business but it does paint a picture. There have been many articles written about Zombie businesses over the years. The term originated in the 1980’s with economists...

Do you need to make staff redundant but cannot afford the cost?

Employers Obligations Employers must make statutory redundancy payments to redundant employees who meet the qualifying criteria for redundancy under the Employment Rights Act 1996. In most cases this will be employees who have worked continuously for their employer for 2 or more years. You are required by law to consult...

Lifelines to Businesses affected by Covid-19

Thankfully the government has listened to the business community and has come up with lifelines which will help businesses look after their teams and make sure they can put food on their table and pay the rent/mortgage, etc and ultimately this will save lives. The Lifelines Coronavirus Job Retention Scheme...

Compensation Orders – What Directors need to know

Article by Laura Walshe of The Business Debt Advisor Many business owners and directors will be aware of the company director disqualification regime, which has been in force for more than 30 years. Each year approximately 1,200 directors are made subject to either a disqualification order, or an undertaking which...

Closing down Contractor companies – solvently or insolvently

Bev Budsworth MD of The Business Debt Advisor IR 35 Changes The Government has confirmed the IR 35 extension into the private sector and that this will apply to services carried out from 6 April 2020. This only relates to companies which are not small under Companies Act 2006 who...

Research shows that 1 in 5 UK businesses in financial stress

Article by Laura Walshe of The Business Debt Advisor Recent research by KPMG highlights that as many as one in five UK companies are in a position of financial stress. Economic uncertainty gave rise to a particularly tough year for the building and construction industry and the real estate and...

UK Government warned against cutting Entrepreneur’s Relief

Article by Laura Walshe of The Business Debt Advisor Under the current legislation it is possible to pay less Capital Gains Tax when selling, or disposing of, all (or part) of your business. Entrepreneurs’ Relief enables a business owner to pay tax at 10% on qualifying assets and gains, after...

Tax Benefits of Solvent Liquidation (Members Voluntary Liquidation) “MVL”

Has your company built up a sizeable pot of cash and assets over its trading life? If the answer is yes and you intend to cease trading, you could distribute the residual cash and assets to shareholders using the Members Voluntary Liquidation (“MVL”) procedure. The MVL procedure is commonly used...

HMRC “loan charge” tax crackdown criticised by MPs – what to do if you’ve been affected

MPs have criticised a HMRC tax crackdown which attempts to claw back money from people who used tax-planning schemes they thought were legal. As reported by The Independent, the politicians warned that the new measures have caused "widespread anxiety and distrust" and have claimed that the "loan charge" has driven...

Councils sue 750 firms a day struggling with business rate arrears

Around 190,000 shops, pubs and other firms have been sued by councils in the past year for struggling to pay rising business rates, according to new data. That equates to 750 firms every working day who were taken to court for non-payment of their business rates during the 2018/19 financial year. Under...

Business investment declines with threat of ‘No Deal Brexit’ – how it could affect UK business owners

The threat of a 'No Deal Brexit' has sapped business confidence to its lowest level in a decade, with Britain reportedly on course for the biggest decline in business investment since the financial crisis. According to a Deloitte survey of Chief Financial Officers across the UK, CFOs are more pessimistic about...

The Business Survival Checklist

Article by Laura Walshe of The Business Debt Advisor It has been broadly reported that company insolvencies in the UK increased in the first quarter of 2019 with some insolvency processes at their highest level in five years. The team at The Business Debt Advisor has reflected on why businesses fail and...

Dealing with Late Payment of Commercial Debt

Article by Laura Walshe of The Business Debt Advisor Nearly 25% of UK businesses report that late payment of invoices threatens their survival. Last year, The Federation of Small Businesses (FSB) obtained assurances from the Chancellor of the Exchequer that the Government will take steps to crack down on the late...

Why Do Businesses Fail?

Article by Laura Walshe of The Business Debt Advisor The UK is full of ambitious and talented business owners with thousands of new ventures launched each month. Despite this, the overall number of company insolvencies in the first quarter of 2019 increased. The latest statistics on company insolvencies in England and Wales...

British Steel To Enter Insolvency – What Went Wrong?

British Steel is set to enter insolvency, a move which will put more than 5,000 jobs at risk. The manufacturing company is on the verge of collapse after a breakdown in rescue talks between the government and the business' owner, Greybull. As reported by the BBC, the Government's Official Receiver will...

Dealing with Judgment Debt

Article by Laura Walshe of The Business Debt Advisor A County Court Judgment (CCJ) is essentially a County Court Order which enforces the payment of an unpaid debt. A CCJ against a limited company is likely to be the culmination of several attempts by a creditor to recover unpaid debt. If...

Managing Risk – Is your business prepared for Brexit?

Article by Laura Walshe of The Business Debt Advisor The UK’s departure from the European Union will inevitably mean change for businesses across all sectors, including small enterprises. While some businesses are already planning for the challenges and opportunities ahead, it would be useful for all companies to review current processes...

When is Voluntary Liquidation suitable for your business?

Article by Laura Walshe of The Business Debt Advisor There are many great reasons to start a business, but taking on the challenge of running a successful enterprise is not for the faint-hearted. At the end of 2018, the number of companies listed on the Companies House register was 3,879,844 (excluding...

Bolton Wanderers FC – Troubled Club Survives High Court Hearing

Article by Laura Walshe of The Business Debt Advisor Bolton Wanderers FC is no stranger to financial difficulty, having faced several winding up petitions for unpaid taxes within the last 18 months. But the club survived another hearing in the High Court yesterday, after it was granted an additional five weeks...

London Capital & Finance Collapse: Thousands Of Customers Unlikely To Get Compensation

Thousands of first-time investors who lost their savings through London Capital & Finance (LCF) have been told they are unlikely to receive compensation. Nearly 12,000 customers invested more than £236m in total into the high-risk bond scheme before LCF collapsed in January. As reported by the BBC, the scheme was marketing as...

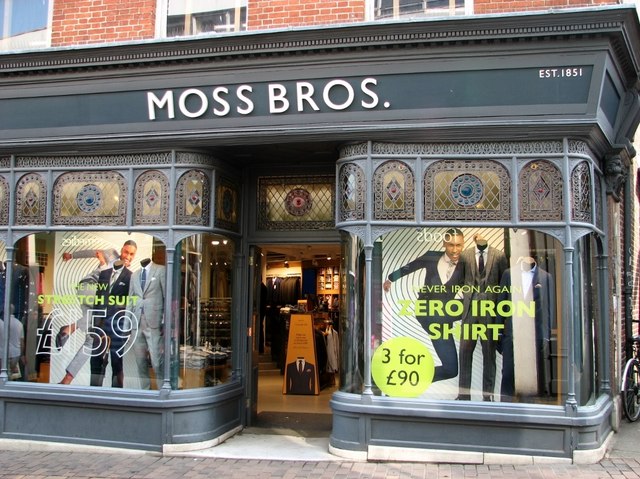

Is Moss Bros ‘Out of Fashion’?

Article by Laura Walshe of The Business Debt Advisor Moss Bros Group PLC was originally founded in 1851 in London. The company has previously been one of the UK’s top menswear outlets, specialising in menswear for formal occasions, and currently ranked in the Top 50 of the IRUK Top 500 (Internet...

Making Tax Digital – Is Your Business Prepared?

Article by Laura Walshe of The Business Debt Advisor Making Tax Digital is part of government plans to make it easier for individuals and businesses to get their tax liabilities correct and keep on top of their affairs. The initiative will implement fundamental changes to the way the current tax system...

What’s the use of limited liability for directors?

By Bev Budsworth of The Business Debt Advisor and Joss Dicks of Personal Guarantee The benefit of trading through a limited company or limited liability partnership has been seriously eroded over the years. It used to be just the banks that asked for personal guarantees, but over the years, requesting...

Dissolution Vs Liquidation Made Simple

Article by Laura Walshe of The Business Debt Advisor At the end of last year, there were over 4 million companies on the Companies House register, which included those in the process of dissolution and liquidation. From October to December 2018 alone, there were 158,841 incorporations and 112,121 dissolutions. Even with...

Business Survival – Tips on Driving Profitability

Article by Laura Walshe of The Business Debt Advisor Small and medium sized enterprises (SME’s) make up the majority of businesses operating within the UK. In 2018, there were 5.7 million private sector businesses operating within the UK, down by 27,000 compared to 2017. This is the first year-on-year fall in...

What are an employee’s rights during insolvency?

Article by Laura Walshe of The Business Debt Advisor Learning that you are at risk of redundancy is stressful in any situation. Being made redundant as a result of your employer entering into an insolvency process can be even more distressing. In many cases where a company pursues an insolvency solution,...